6 Estate Planning Must-Haves

An estate planner can assist you stop essential bad moves and also aid you in readjusting your strategies as your conditions, as well as laws, modification. The details here is academic and also basic in nature and also must not be considered legal or tax guidance. Tax laws as well as laws are subject and complicated to transform, which can materially impact investment outcomes. Fidelity can not assure that the information here is precise, full, or prompt.

Will vs. Living Will.

Fidelity makes no service warranties with regard to such info or results obtained by its usage, as well as disclaims any kind of responsibility occurring out of your use, or any tax setting absorbed reliance on, such details. Seek advice from a lawyer or tax obligation expert concerning your details situation.

The majority of people need a generalist that can assist draft http://arthurrdbh970.simplesite.com/445778957 a will, powers of attorney, and standard depends on. But some scenarios require attorneys with certain specializations. As an example, you may have reason to be especially worried regarding optimizing benefits programs like Medicaid, or dealing with long-term treatment, in which situation you may need an expert in senior law. If you have monetary interests overseas, you may require the skills of a lawyer who specializes in international estate planning. Also, if your case calls for lawful operate in more than one jurisdiction or state, be sure to take into consideration lawyers that are licensed to exercise in all those locations.

Depending on where you live as well as exactly how challenging your family and also financial conditions are, a legal representative may charge anything from a couple of hundred to numerous thousand dollars for a will as well as other basic estate planning documents. For instance, in Florida, a personal representative needs to either be related to you by blood or marital relationship or, otherwise, after that a resident of the state. Over and over again I see wills of Florida residents that assign a friend or attorney from out of state as the individual agent. This non-resident, non-relatives simply can not offer, and also actually, will not be permitted to serve, in Florida. Collaborating with a professional estate planning attorney will aid you to prevent this type of basic as well as yet costly mistake.

- Generally, straightforward estate strategies, consisting of a will, power of lawyer, as well as medical instructions, can set you back from $300 to $1,200.

- If you've just recently experienced a major life event such as remarriage, death of a member of the family, divorce, lasting impairment, or inheritance, it might be time to take a fresh look at your estate plan also.

Numerous legal representatives, including estate legal representatives, promote with various means, including in print, on the radio or on TELEVISION. All states manage lawyer marketing, so just ads that pass the stringent examination of the state bar association are allowed. This makes sure that the attorney isn't making incorrect cases or promising unattainable results. Opportunities are your attorney will certainly have an estate strategy that was prepared by an additional neighborhood legal representative who specializes in estate preparation. Likewise, lots of accounting professionals seek out estate preparation attorneys for their customers considering that accounting professionals have straight access to their clients' economic details as well as household situations which necessitate the requirement for an estate plan.

Basic types of trusts.

When accomplishing estate preparation, your goals are to make certain that your desires are fulfilled which you get one of the most protection possible, yet you likewise wish to take care of costs. So if you're choosing between producing a will certainly or a living trust, expense can play a big duty in your consideration.

What is the most profitable area of law practice?

Once the contents of the trust get inherited, they're just like any other asset. As a result, anything you inherit from the trust won't be subject to estate or gift taxes. You will, however, have to pay income tax or capital gains tax on your profits from the assets you receive once you get them, though.

Just how to Find an Estate Planning Attorney

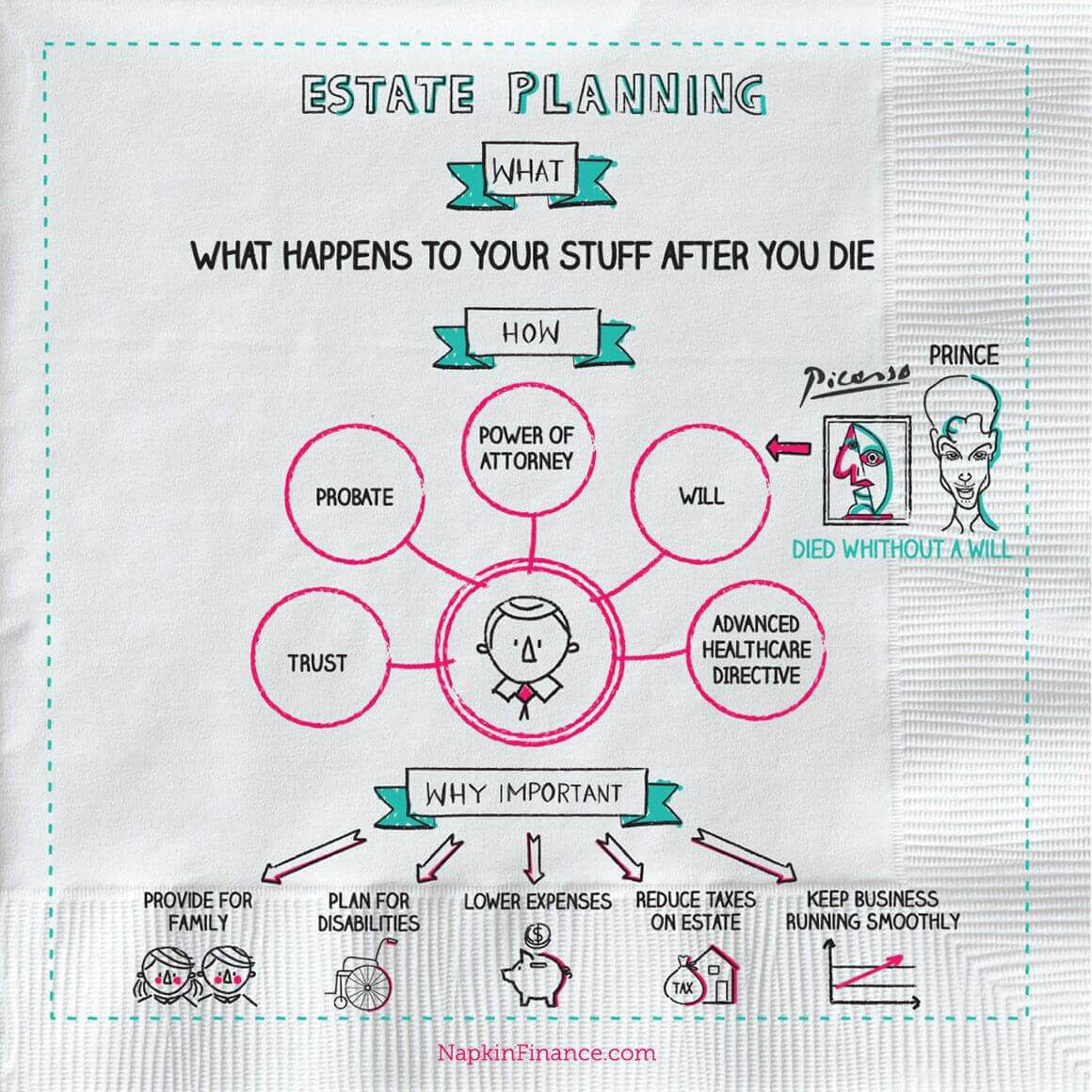

The term estateplanningcan be defined as the process of making a plan ahead of time to manage an individual's estate in an expectancy of death or illness. A common mistaken belief is that only wealthy people ought to prepare files for medical regulations, wills, depends on, and guardianship, however this myth couldn't be additionally from the truth. Regardless of the individual, in order to develop a fantastic estate strategy you require a skilled household depend on attorney who totally recognizes your scenario as well as distinct wishes.

Without an estate strategy, these decisions may be entrusted to the near relative or the state. If you wish to prevent lawful charges or can not pay for a lawyer, Nolo's Quicken WillMaker software permits you to develop a tailored as well as detailed estate plan for your whole household. Initially, they can use types that they have actually already created-- most estate planning attorneys have a collection of common provisions that they have actually composed for various circumstances, which they put together into a will that fits a new client's wishes.

As an example, he should ask simple concerns like "That do you intend to manage your company, sell your residence, or make sure your recipients receive your money when you die? " instead of possibly complicated concerns like "That would certainly you like to be the principal recipients of your revocable trust? " The previous inquiry is not just one that you can in fact recognize but it also suggests that your lawyer recognizes and also desires to assist you at all feasible.

You might also be positioned accountable of the development of any type of linked count on funds to certain assets. A list to help you take care of your family by making a will, power of lawyer, living will, funeral arrangements, and a lot more.

Straightforward Steps to an Estate Strategy.

- The last question develops a barrier between you and your lawyer merely since you possibly can't understand him.

- We ask great deals of concerns concerning life support as well as whether you intend to be an organ donor.

- The content as well as web links on planned for general information objectives only.

Our company proudly gives assistance with family legacy count on, preparation as well as estate administration, inheritance tax matters, trust fund development, as well as extra. Unlike lots of huge companies in the location, we just approve customers who have an interest in organisation and estate planning.Contactus today to get more information concerning our special solutions at. A good question to ask an estate planning lawyer is the amount of time it will take https://www.bbb.org/us/ca/irvine/profile/legal-services/masson-fatini-llp-1126-1000061721/#sealclick him to prepare the plan. If you are ready as well as organized, the majority of knowledgeable attorneys can prepare an initial draft of the plan within a couple of weeks.

Estate coordinators collaborate with clients, offering bookkeeping, economic, and lawful guidance to assist them plan for end-of-life and also succession issues. The major objective of estate preparation is to safeguard customers' possessions as they pass from their ownership to their wanted inheritors. Once a client dies, an estate strategy would determine the dispersal of possessions per the deceased's instructions.

What are the disadvantages of a trust?

The long and the short of it is this: elder law attorneys understand not just Medicaid law, but also all the secondary considerations and issues related to Medicaid. Typically, their services will cost no more than a month or two of nursing home care – and save you much more than that, over the long term.

of the Richest Attorneys in America.

Here is a simple list of one of the most vital estate intending concerns to consider. Referrals from friends and family or on the internet research study may be a good beginning. Nevertheless, not all internet sites are the same and also unless you reside in the same state as your pal or loved one, or have endless hours to invest on the internet, you may want to discover a neighborhood elder legislation attorney making use of FindLaw's lawyer directory.

Is it better to have a will or a trust?

The Benefits of QTIP Trusts A QTIP trust is a marital trust designed to provide for your spouse after your death while protecting your assets for future generations. The QTIP trust also offers flexibility to your Executor in maximizing your federal estate tax savings.

Property You Need To Not Include in Your Will

After your fatality, the properties are distributed to your beneficiaries according to your desires as well as on any routine you select. No, you aren't required to hire a legal representative to prepare your will, though an experienced legal representative can supply valuable advice on estate-planning approaches such as living trust funds. Yet as long as your will meets the legal requirements of your state, it stands whether an attorney prepared it or you composed it on your own on the back of a paper napkin. The old Latin saying, "Caveat Emptor," or "Buyer Beware," certainly applies to estate preparation.

If expert qualification is available in your state, bench organization will certainly have information on it.Before applying for accreditation, an attorney should have a particular number of years of experience practicing law in the location, generally at the very least five. Preparation your estate includes determining what will take place to your personal effects as well as realty after you pass away. The legislation supplies a default system for disposing of building, however relying on that involves a lengthy court process as well as possibly significant tax effects for your beneficiaries.

Wills make certain property is dispersed according to an individual's dreams (if prepared according to state regulations). If you hire an attorney to produce your living trust fund, she will likely develop the trust fund as component of a comprehensive estate strategy. To completely attain all required defenses, you need a will, powers of lawyer, as well as healthcare instructions, along with your living trust.

First, without a full discussion of the individual's scenario, the attorney might give the incorrect solution. So, lawyers generally hesitate to provide details advice without being officially involved by the customer. Picking and also developing a trust can be a complicated procedure; the advice of an attorney with estate planning proficiency is highly suggested. If your key aim is to decrease the amount topic to estate taxes by properly removing the trust fund properties from your estate, an unalterable depend on is usually favored over a revocable count on.

Legal Information & More from Nolo.

- You likewise require to change ownership of any other asset positioned in the depend on, such as financial institution autos, financial investments, as well as accounts.

- Elder legislation lawyers are advocates for the senior as well as their enjoyed ones.

Should I hire a lawyer to write my will?

Most elder law attorneys handle a wide range of legal matters affecting an older or disabled person, including issues related to health care, long term care planning, guardianship, retirement, Social Security, Medicare/Medicaid, and other important matters.

Below's a listing of 7 sources for situating an estate planning lawyer in your state. Julie Ann Garber wrote about estate preparation for The Equilibrium, as http://archerbjqi449.jigsy.com/entries/general/6-estate-preparation-must-haves well as has almost 25 years of experience as a lawyer as well as trust policeman.

What are the disadvantages of a trust?

The cost of setting up a living will varies from state to state, depending on whether it must be witnessed by a notary. Costs typically fall between $250-$500 to hire a lawyer to draft the living will, while forms can be self-completed for between $45 and $75.

Often Asked Inquiries for Senior Citizen Law Lawyer.

Your lawyer or somebody you rely on should keep signed copies in situation the initial is damaged. However, the lack of an initial will can complicate matters, and without it there's no warranty that your estate will certainly be settled as you 'd really hoped. You can call your spouse, an adult youngster, or an additional relied on buddy or relative as your administrator. If your events are complicated, it may make even more sense to call a lawyer or somebody with legal and also monetary knowledge.

Checklist of legal records: 4 papers every adult should have in place

Otherwise, you should consider getting these essential documents in position immediately. You wish to ensure that your assets are distributed which your descendants are cared for as is ideal for them when you're gone-- while assuring on your own you've done all you can. When executing estate preparation, your objectives are to make certain that your desires are fulfilled and that you receive one of the most protection possible, yet you also want to handle costs. So if you're deciding in between creating a will certainly or a living trust, cost can play a huge duty in your consideration.

How much does an estate planning lawyer charge?

If one or more of these situations apply to you, then you'll need the counseling and advice of an experienced estate planning attorney to create your estate planning documents. Otherwise, it may be a probate lawyer and your state's department of revenue and/or the IRS that will receive the largest chunk of your estate.

How much is it worth to recognize that when you die, things will go exactly as you meant because you had the help of an experienced estate planning attorney? Make the effort to locate and hire a seasoned and also recognized estate preparation attorney in your location. As an example, in Florida, a personal agent must either be related to you by blood or marriage. Yet wills of Florida locals frequently designate an out-of-state close friend or attorney as the personal rep.

Reasons to Employ an Estate Planning Lawyer

If you work with an attorney to create your living trust fund, she will likely produce the count on as component of a detailed estate strategy. To fully achieve all essential securities, you require a will, powers of attorney, as well as health care directives, along with your living depend on. Ask specifically what is included in the legal representative's fee prior to you accept collaborate.

- Both work estate preparation gadgets that serve different objectives, as well as both can interact to create a complete estate strategy.

- Therefore, it's vital to have a sturdy healthcare power of attorney.

- For instance, if you intend to place your home in the count on, a brand-new deed needs to be produced with the depend on as owner of the home.

Therefore, it's important to have a resilient health care power of attorney. This legal file enables you to appoint a healthcare proxy who is equipped to speak to your medical professionals, gain access to your healthcare info, and also make clinical decisions regarding your care, if you're not able to do so on your own. A healthcare proxy is likewise billed with figuring out which hospital, medical center, taking care of residence, or hospice facility to send you to for treatment. FindLaw.com offers a review of the details needed to do estate preparation as well as an extra thorough estate planning list that you can complete.

Health Care Power of Attorney and also Living Will

Some states enable lawyers to come to be licensed experts in https://en.gravatar.com/wealthadvisors1 a specific location of legislation, such as estates as well as trust funds. If specialist qualification is offered in your state, the bar association will have information on it.Before getting qualification, an attorney should have a particular variety of years of experience practicing regulation in the area, typically a minimum of 5. Preparation your estate includes determining what will certainly happen to your personal property as well as real estate after you pass away.

Greater than a Will: Estate Preparation Packages

Constantly thoroughly veterinarian a lawyer before hiring him, even if he was recommended by a close friend or relative. The types and amount of possessions you have will partially identify both what sort of lawyer you need to seek and just how much that lawyer will bill you to draft a plan for your estate. For instance, in Florida, a personal representative must either be related to you by blood or marriage or, if not, after that a homeowner of the state. Time and time again I see wills of Florida citizens that mark a close friend or attorney from out of state as the personal rep.

And while you're servicing your will, you must consider preparing other crucial estate-planning files. Each state is going to be specific, however you can offer your properties away. You can acquire long-term treatment insurance policy, or you can take your chances and also do nothing. There are waiting periods that have to be fulfilled in order to shield the properties. A will certainly aids direct who is going to be in charge of distributing your assets as you specify.

Marriage Vs. QTIP Trust in Estate Planning

Residential or commercial property You Must Not Consist of in Your Will.

We likewise aid with decision-making files as well as offer guidance on other legal issues for elders and also individuals with specials needs. Because we invest a whole lot of time learning regarding their demands and also desires, we provide clients and their families with a much more alternative technique. We quarterback a team that consists of monetary organizers, accounting professionals, insurance coverage representatives and also various other experts to make and implement an ideal plan for each customer. These funds will be placed in a court-supervised guardianship for the advantage of the minor till the child gets to 18.

Living Trust Funds as well as Estate Plans

What is the average price for estate planning?

On average, trust and estate attorneys charge a minimum of $250 per hour and a maximum of $310. Most trust and estate attorneys offer free consultations, typically for 30-60 minutes. On average, trust and estate attorneys charge a minimum of $250 per hour and a maximum of $310.

Be sure the info provided consists of updated information certain to your state of house; several estate preparation experts recommend versus using one-size-fits-all files unless they're evaluated by an attorney. Having an attorney examine your monetary and also family circumstances and prepare ideal lawful files starts around $800-$1,800 and also can run $2,000-$3,500 or more, relying on intricacy, location and various other situations.

- Take these steps to safeguard your family if you've placed off estate planning.

- As these accounts can not be retitled in the name of your trust fund, rather, the trust fund needs to be designated as the main or second beneficiary of these accounts.

To separate yourself amongst your peers as well as prosper in the area of estate planning, consider earning an online or an on school Master's in Taxation at the D'Amore-McKim Institution of Service at Northeastern College. In addition to the emotional benefit helpful customers with end-of-life preparation, estate coordinators take pleasure in the advantages of a steady earnings. According to a minimal PayScale study of estate coordinators, the typical wage for estate planningis $96,984.

Speak to the monetary institution if you want to alter the beneficiary. It might be better to getting a guardianship for an aging or disabled relative, which is a public and lengthy process. With a revocable trust fund, relative do not need to head to court to ask for a guardianship because the backup trustee simply takes over. Assets not officially held in the trust fund still need to go via probate and will not be under the monitoring of a successor trustee in situation of incapacity. Although assets held in an irreversible trust are normally beyond the reach of creditors, that's not real with a revocable trust fund.

Health savings accounts (HSAs) as well as medical interest-bearing accounts (MSAs) are tax-exempt trust funds or custodial accounts developed to pay medical expenditures that certify. As these accounts can't be retitled for your count on, rather, the depend on must be assigned as the primary or secondary recipient of these accounts.

If several of these situations relate to you, after that you'll need the counseling and also recommendations of a knowledgeable estate preparation lawyer to develop your estate planning files. Otherwise, it may be a probate lawyer as well as your state's department of income and/or the Internal Revenue Service that will receive the biggest chunk of your estate. When taking into consideration if you require to work with an estate planning legal representative, consider this - estate preparation is severe service.

One primary difference between a trust fund and also a will is that a will goes into impact just after you pass away, while a trust works as quickly as you develop it. A will is a document that directs who will receive your property at your death and it designates a legal representative to accomplish your desires.

What Is the Average Cost to Prepare a Living Count On?

( After all, you wouldn't begin refinishing that table without some instructions-- don't compose your very own will up until you understand what you're doing.) As an example, say it's been 3 years since you had a kid, and also you know that you need a will. But you have not navigated to calling a lawyer, as well as you really do not like thinking about the subject anyway. You can quickly produce a basic, valid will with a software program or online application, and be done.

Resilient health care power of lawyer.

Also, go on as well as ask your consultant that did his or her own individual estate strategy-- the answer might be simply who you're looking for. FindLaw.com provides an introduction of the details needed to do estate planning along with a more comprehensive estate planning checklist that you can fill out.

You will, nonetheless, need to pay income tax or funding gains tax on your profits from the possessions you get once you obtain them, however. Later on, if, you have questions or believe you may require more estate planning, get individualized suggestions from a specialist.

Estate Planning: A Quick Review of QTIP Trust fund vs. Marital Depend on.

What you must do is alter the second or primary beneficiary of your account to your count on. A will or a trust fund may appear challenging or pricey-- something just rich people have. A will certainly or trust needs to be just one of the primary elements of every estate strategy, also if you don't have significant properties.

- Many individuals believe that having an estate plan merely suggests composing a will or a trust

- In comparison, attorney's fees for drafting a will certainly are much lower, typically $200 to $400 for a specific as well as $300 to $500 for a pair.

- As constantly, consult your estate preparing attorney to comprehend each of these specific matters.

Make certain the information gave consists of updated information certain to your state of residence; many estate preparation specialists recommend versus making use of one-size-fits-all documents unless they're assessed by an attorney. Having a lawyer review your monetary as well as household conditions as well as prepare ideal legal records begins around $800-$1,800 and also can run $2,000-$3,500 or even more, depending upon complexity, location as well as various other conditions.

Can I do my own estate planning?

A trust is a legal device by which property is distributed to beneficiaries named in the trust. Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

As an estate organizer, you can collaborate with a family through generations. When one customer dies, it's common for an estate organizer to be enlisted by any kind of number of the enduring family members. If you're more comfortable with one means or one more, you might want to ask up front. An unalterable depend on can not be customized, modified or ended without the authorization of the grantor's named recipient or beneficiaries.

Comprehending the Distinctions Between a Will as well as a Count on

By comparison, a trust fund can be made use of to start dispersing residential property before fatality, at death, or later on. Chances are a legal representative you have actually dealt with in setting up your service, purchasing your home, or evaluating an agreement will certainly understand one or more professional estate planning attorneys in your location. And lawyers are always quite satisfied to refer their customers to other lawyers that do not practice in their area of know-how since this will advertise references back the other method. Numerous experts view estate planning as a crucial part of their customers' total monetary goals, therefore these experts have several estate legal representatives that they'll refer their customers to depending upon http://edgarxgzo372.iamarrows.com/how-much-will-a-lawyer-charge-to-write-your-will each customer's specific needs. Your monetary advisor must be a great source of information for you, including finding a certified estate planning lawyer in your area.

Recognizing the Distinctions In Between a Will as well as a Depend on

If this applies to your state, after that you may wish to hold back and purchase your brand-new automobile in the name of the trust. Aside from this, in some states probate is not essential to move ownership of a car after the owner passes away. Certain states currently enable lorry proprietors to mark a beneficiary after fatality.

Speak with an Estate Preparation lawyer.

Experts will act as trustees for a cost (typically a percent of the worth of depend on possessions), however only if the value of the trust fund assets is large enough. A terminable interest is a passion in home that will certainly end upon the occurence of a particular occasion or contingency, after a particular time period, or on the failure of an event or condition to occur.

Qualified retirement accounts, consisting of 401( k) s, 403( b) s, IRAs, as well as qualified annuities, should not stay within your revocable living depend on. The reason is the transfer would certainly be treated as a total withdrawal of funds from your account. Subsequently, 100 percent of the value would go through revenue tax obligation in the year the transfer is made. What you ought to do is transform the key or additional beneficiary of your account to your trust fund. A living depend on is a choice for estate planning that can be extremely eye-catching.

Many territories do not offer similar adaptability for revocable trusts. Consequently, when situations change, the grantor needs to make sure to make the necessary changes to the stipulations of a revocable depend on. There are a couple of disadvantages that might apply to utilizing a revocable count on instead of a will.

How do you decide who to put in your will?

Step 3 in the Financial Planning Process: Analyzing and Evaluating your Financial Status #FinancialPlanning. The third step in the financial planning process is analyzing and evaluating your financial status. Most planners will evaluate and help you plan for as much or as little as you would like.

- The minimal net worth required for a single person to take into consideration utilizing a Revocable Living Count on will differ from one state to another.

- Unlike a will, which becomes part of the public document, a trust fund can remain private.

Staying Clear Of Unneeded Probate Expenses

In numerous families, it makes good sense for partners to set up reciprocal powers of attorney. Nonetheless, in many cases, it could make even more sense to have one more relative, friend, or a relied on consultant that is even more financially smart serve as the representative.

How do you prepare a simple will?

The Benefits of QTIP Trusts A QTIP trust is a marital trust designed to provide for your spouse after your death while protecting your assets for future generations. The QTIP trust also offers flexibility to your Executor in maximizing your federal estate tax savings.

One main distinction between a will and also a depend on is that a will goes into result just after you die, while a trust works as soon as you create it. A will certainly is a file that guides that will obtain your building at your death and also it selects a legal representative to perform your dreams. By contrast, a depend on can be utilized to begin dispersing residential property prior to death, at fatality, or later on. Notably, the enduring spouse is just qualified to take advantage of the depend on's profits when in their control, while the originally desired recipients are able to use the concept financial investments also.

If you hold your residential or commercial property in a living depend on, your survivors won't have to go with probate court, a expensive and also taxing process. If you intend to avoid legal fees or can not afford a lawyer, Nolo's Quicken WillMaker software permits you to http://israelflpw472.wpsuo.com/reasons-to-hire-an-estate-planning-attorney develop a customized and also detailed estate prepare for your entire household.